Finance teams play a critical role in keeping organizations running smoothly, but their work often involves time-consuming, repetitive tasks like managing invoices, processing expense reports, reconciling accounts, and ensuring compliance across the business … just to name a few. These essential processes can quickly become bottlenecks when handled manually, leading to inefficiencies, errors, and delays across the business.

Definition of finance process automation

Finance process automation leverages automation technology to streamline financial operations, reducing manual effort and increasing efficiency. Many organizations choose to automate tasks such as invoicing, expense management, payroll processing, and financial reporting. By automating these processes, organizations can minimize errors, improve compliance, and gain better visibility into their financial data.

Why automate your finance processes?

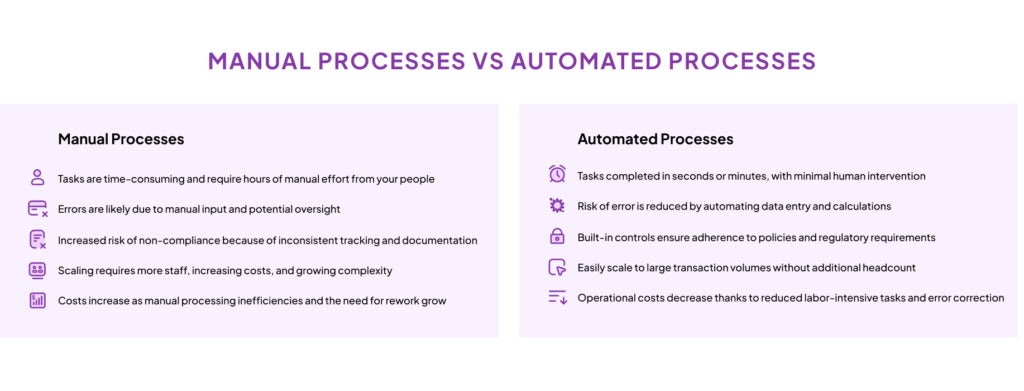

Unlike manual finance processes that rely heavily on human input and paper-based systems, finance process automation uses digital tools to handle repetitive tasks. This transition speeds up transaction times and allows finance professionals to focus on strategic initiatives rather than mundane administrative work. Traditional methods can lead to delays and inaccuracies due to human error, while automated processes ensure consistency and speed.

Key technologies involved in finance process automation include robotic process automation (RPA), artificial intelligence (AI), agentic AI, cloud-based process automation, and process optimization.

RPA automates routine tasks through software bots, while AI analyzes vast amounts of financial data to provide insights and predictive analytics. Cloud-based solutions enable real-time access to financial information, facilitating swift collaboration and decision-making. Together, these technologies create a powerful framework that transforms the financial landscape, allowing organizations to achieve greater operational efficiency.

Key processes to automate in finance

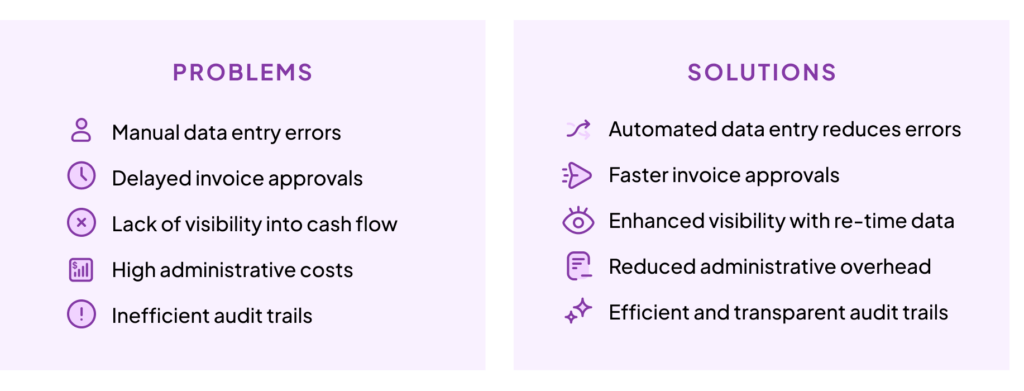

In the finance sector and in finance departments across industries, automation is essential for efficient operations. One great place to start automation in your finance department is invoice processing and management. Traditional methods involve manual data entry, leading to errors and delays. Automating this process ensures faster approvals, reduced errors, and enhanced visibility into cash flow.

Another critical area for automation is expense reporting and approvals. Employees spend valuable time submitting expense reports, causing bottlenecks in the approval process. Automation streamlines the workflow, enabling quicker submissions and reviews, while also providing compliance and audit trails that keep financial operations transparent and accountable.

Automating accounts receivable processes saves your finance teams the hassle of bill collection by streamlining accounting processes, so you can get paid faster, improve cash flow predictions, and lower bad debt.

Financial reporting and forecasting also benefit greatly from automation. Automated solutions gather and analyze data in real time, producing accurate financial reports essential for strategic decision-making. This saves time and allows finance teams to focus on analyzing data rather than compiling it. Automating these key processes enhances efficiency, reduces costs, and drives better financial outcomes.

Problems and solutions with invoice automation

Three benefits of finance process automation

Finance process automation offers multiple advantages that significantly improve the overall performance of financial operations:

- Increased efficiency and accuracy. Automating repetitive processes such as invoice approvals, expense tracking, and financial reporting reduces the likelihood of human error while speeding up workflow. This enables teams to focus on more strategic initiatives and ensures that financial data is processed in real-time, providing timely insights for decision-making.

- Substantial cost savings and better resource allocation. Financial process automation minimizes manual labor and reduces administrative overhead. Resources previously tied up in tedious tasks can be redirected toward more value-added activities, driving profitability. Automation solutions often come with advanced analytics capabilities, enabling finance teams to identify inefficiencies and optimize spending, further improving financial health.

- Enhanced compliance and risk management. Because automated workflows are designed to adhere to regulatory requirements and internal policies, reducing the risk of non-compliance. Maintaining a clear audit trail and ensuring consistent application of compliance measures helps organizations better manage risk and protect against potential financial discrepancies. In a complex regulatory environment, this capability is invaluable for safeguarding an organization’s integrity and reputation.

Potential challenges when implementing finance process automation

While finance process automation can significantly improve efficiency and accuracy, organizations often face challenges that can hinder successful adoption. One primary obstacle is resistance to change within organizations. Employees may be accustomed to traditional methods and reluctant to embrace new technologies. This apprehension can lead to pushback during the automation transition, making it essential for leaders to foster a culture of innovation and provide adequate training to ease the transition.

Another significant challenge is integrating with existing systems. Many organizations operate on a patchwork of legacy systems that may not easily connect with new automation tools. Ensuring seamless integration is crucial for maintaining data consistency and operational efficiency. This often requires a thorough assessment of current systems and careful planning to ensure that automated processes fit harmoniously within the existing infrastructure.

Data security and compliance concerns also pose a substantial hurdle in finance process automation. Financial data is sensitive and heavily regulated, so organizations must prioritize robust security measures and compliance protocols. Automating financial processes can create vulnerabilities if not properly managed, necessitating a comprehensive approach to data protection and adherence to industry regulations.

How to implement finance process automation

Implementing financial process automation can significantly improve operational efficiency and accuracy in your organization. Here’s how you can get started:

- Start by evaluating your automation needs. Identify repetitive tasks within your finance department that are time-consuming and prone to errors. Engage with your team to gather insights on their daily workflows and pinpoint areas where automation could streamline processes, reduce manual intervention, and improve overall productivity.

- Once you’ve assessed your needs, the next step is to choose the right tools and technologies. Look for solutions that align with your specific requirements and seamlessly integrate with your existing systems. Consider scalability, ease of use, and support options when selecting your tools to ensure they can grow with your organization.

- Effective training and change management for employees are critical to the success of your automation initiative. Introduce a comprehensive training program that familiarizes employees with the new tools and processes. Encourage a culture of adaptability, where staff members feel supported during the transition. By providing ongoing training and resources, you can help reduce resistance and ensure a smooth integration of automation into your finance operations.

Future trends in finance process automation

The finance industry is on the verge of a transformation driven by advancements in finance process automation, particularly through the integration of artificial intelligence (AI) and agents. These technologies enable organizations to streamline operations, improve decision-making, and enhance accuracy in financial transactions.

AI algorithms can quickly analyze vast amounts of data, identifying patterns and insights that lead to more informed financial strategies. Meanwhile, agentic AI can adapt over time, learning from past transactions to predict future trends and automate repetitive tasks, freeing up valuable human resources for more strategic initiatives.

Another significant trend is the integration of finance process automation with other business functions. As companies strive for greater efficiency, breaking down silos between departments becomes even more important. By automating finance processes, organizations can achieve seamless data flow between finance, sales, procurement, and human resources. This holistic approach reduces errors and fosters collaboration, ensuring that all departments align with the company’s financial goals.

The impact of regulatory change is another major factor driving the importance of financial process automation. As financial regulations continue to evolve, automation tools must adapt accordingly to ensure compliance. Automated systems help organizations stay updated with the latest regulatory requirements, facilitating real-time reporting and audits. By integrating compliance checks into automated finance processes, businesses can mitigate risks associated with non-compliance while improving overall operational efficiency.

Frequently asked questions (FAQs)

What is finance process automation?

Finance process automation involves using technology to streamline and enhance financial operations, reducing manual effort and increasing efficiency. It includes tasks such as invoicing, expense management, payroll processing, and financial reporting.

Why is finance process automation important?

Finance process automation is important because it improves efficiency, accuracy, and compliance in financial operations. It helps minimize errors, enhances visibility into financial data, and allows finance professionals to focus on strategic initiatives.

What technologies are used in finance process automation?

Key technologies used in finance process automation include robotic process automation (RPA), artificial intelligence (AI), and cloud computing. These technologies automate routine tasks, analyze financial data, and provide real-time access to financial information.

How can finance process automation benefit my organization?

Finance process automation can benefit your organization by increasing efficiency, reducing errors, saving costs, improving compliance, and providing timely insights for decision-making. It allows finance teams to focus on strategic initiatives and optimize resources.

What are the challenges in implementing finance process automation?

Challenges in implementing finance process automation include resistance to change, integration with existing systems, and data security and compliance concerns. Addressing these challenges requires careful planning, adequate training, and robust security measures.

Ready to implement finance process automation in your organization? Learn more about how Nintex can support you as you modernize your finance processes.