Policy underwriting

Deliver efficient, transparent, and automated policy underwriting

Capabilities Included:

- Connectors

- Forms & Mobile

- Process Management

- Workflow

Benefits

Easier document processing

Eliminate paperwork and labour-intensive manual processing of client documents.

Saves time and effort

Streamline the customer onboarding process to get rid of repetitive tasks and constant check-ins.

Consistent and accurate

Ensure you capture necessary information every time so nothing important is missed.

Take the faster path from quote to insured

The speed and accuracy of the underwriting process is core to an insurer’s success. With Nintex, now you can ensure that the right policy and price are secured efficiently and precisely, and in a way that’s easy for a prospective customer to follow.

Don’t lose customers due to lack of transparency

As insurance customers have more choices, creating a great experience is increasingly crucial to winning their business. This can be hard to do when a sophisticated underwriting and background check process is happening where the customer can’t see it. By providing visibility into the process, you can make transparency a differentiator and become a hero for customers.

Provide a superior front-end user experience

With Nintex, the moment an insurance application is submitted the underwriting process begins. The applicant is informed every step of the way, from review to approval to signature and onboarding. Meanwhile, the policy is automatically created, risk-assessed, reviewed, and updated into records. Automation streamlines, expedites, and improves the process for users, end to end.

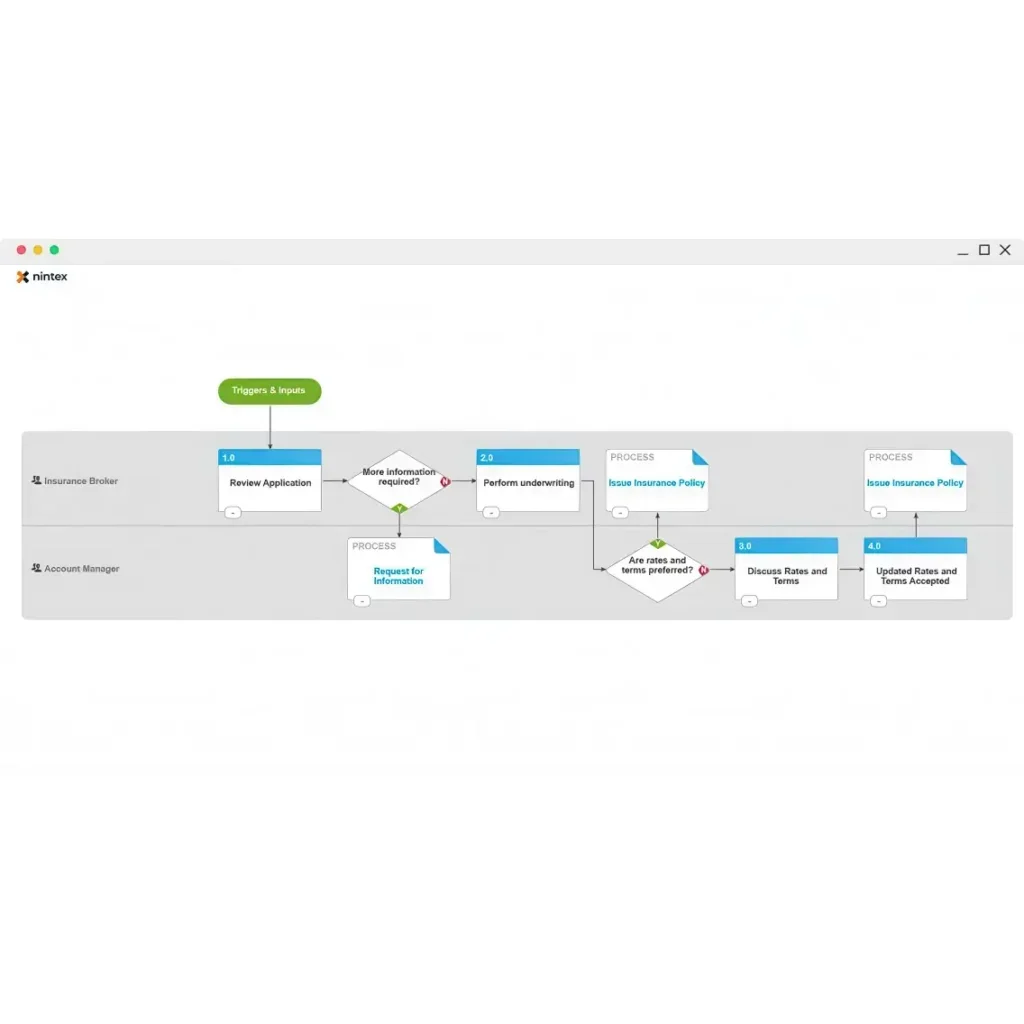

Faster, more accurate underwriting processes

From reviewing the application all the way to issuing the policy, the policy underwriting process can now be mapped and automated to increase efficiency and precision. Brokers and managers are prompted for action, and documents are instantly transmitted to the customer.

Why Our Customers Trust Nintex on

Related use cases

Streamline, automate, and solve with Nintex

Explore related use cases showing how Nintex solves real-world business problems, from automating routine tasks to simplifying complex workflows.

Discount approvals

Automate your discount approval process with Nintex

Customer compliance

KYC checks are important to avoid risky associations and potential fines. See how Nintex can help to improve processes.

Loan processing

With capabilties like workflows, process mapping, and document generation, the Nintex Platform can help your bank streamline loan processing.

Reduce operational risk

Manage risk, reduce costs, and increase productivity with the most powerful, easy-to-use platform for process automation and intelligence.

See for yourself

Put Nintex to the test

Because seeing is believing, let us give you a firsthand look at how Nintex can work for you.